A receipt for payment is a crucial document that serves as proof of financial transactions between parties. It contains vital information about the payment, including the amount paid, date, and other relevant details. Here, we will discuss an example of a receipt for payment template, its important components, writing styles, DocuKng’s curated example templates, optimizing your receipt for payment template, common questions about receipts for payment, and more.

The first section of the receipt for payment template is the problem. It outlines the issue that needs to be resolved or the problem that the customer is facing. For instance, if a customer has made a purchase and they need a receipt as proof of payment, the problem section would state that the customer requires a receipt for their records.

The second part of the receipt for payment template is the agitation. It highlights the negative consequences or difficulties that the customer may face if they don’t have a receipt. For example, it could mention that without a receipt, the customer may not be able to claim a refund or warranty service.

Next is the solution. It presents the product or service as the solution to the problem outlined in the previous section. In this case, it would be the receipt for payment template that provides a solution to the customer’s need for proof of payment.

Then there’s the features and benefits. It highlights the key features of the product or service and explains how they benefit the customer. It could mention that the receipt for payment template has a user-friendly interface and provides all the necessary information about the payment in one place.

Last section is the call to action. It encourages the reader to take action by purchasing or using the product or service. It would be to download or use the receipt for payment template to ensure that they have all the necessary information about their financial transactions.

A receipt for payment template is an essential document that provides proof of financial transactions between parties. It contains vital information and can help customers in various ways. By understanding its components and features, customers can make informed decisions when it comes to managing their finances. With DocuKng’s curated example templates, optimizing your receipt for payment template is easier than ever before.

So what are you waiting for? Start using the receipt for payment template today and ensure that all your financial transactions are documented accurately and efficiently.

| Sections | Topics Covered |

|---|---|

| Example of a Receipt for Payment Template: Glossary of Vital Terms | Definition and explanation of key terms used in receipt templates. |

| Important Components of a Receipt for Payment | Identification and description of the essential elements that should be included in a receipt template. |

| Writing Styles for a Receipt for Payment Template | Overview of different writing styles that can be used in receipt templates, including formal and informal styles. |

| DocuKng’s Curated Example Templates for Receipts | Explanation of DocuKng’s curated example templates for receipts and how they can be used to create professional-looking documents. |

| Optimizing Your Receipt for Payment Template | Tips and best practices for optimizing a receipt template to ensure it meets the needs of both the sender and receiver. |

Example of a Receipt for Payment Template: Glossary of Vital Terms

Electronic Funds Transfer (EFT): Electronic Funds Transfer is a method of transferring money from one account to another without the use of physical currency. It involves the direct electronic exchange between banks, and it’s commonly used for business transactions.

Merchant Services: Merchant services refer to the financial services provided by a bank or other financial institution to businesses that accept credit card payments. These services include payment processing, fraud protection, and chargeback management.

Point of Sale (POS) System: A Point of Sale system is a computerized system used for the sale and billing of goods and services in a retail or service-oriented business. It typically includes a cash register, barcode scanner, and credit card reader.

Recurring Payments: Recurring payments are automatic payments made on a regular basis, such as monthly or annually. They’re commonly used for subscription-based services like magazine subscriptions or software licenses.

Secure Sockets Layer (SSL): Secure Sockets Layer is a security protocol that provides encryption for data transmitted between a web server and a browser. It’s commonly used to secure online transactions, such as credit card payments.

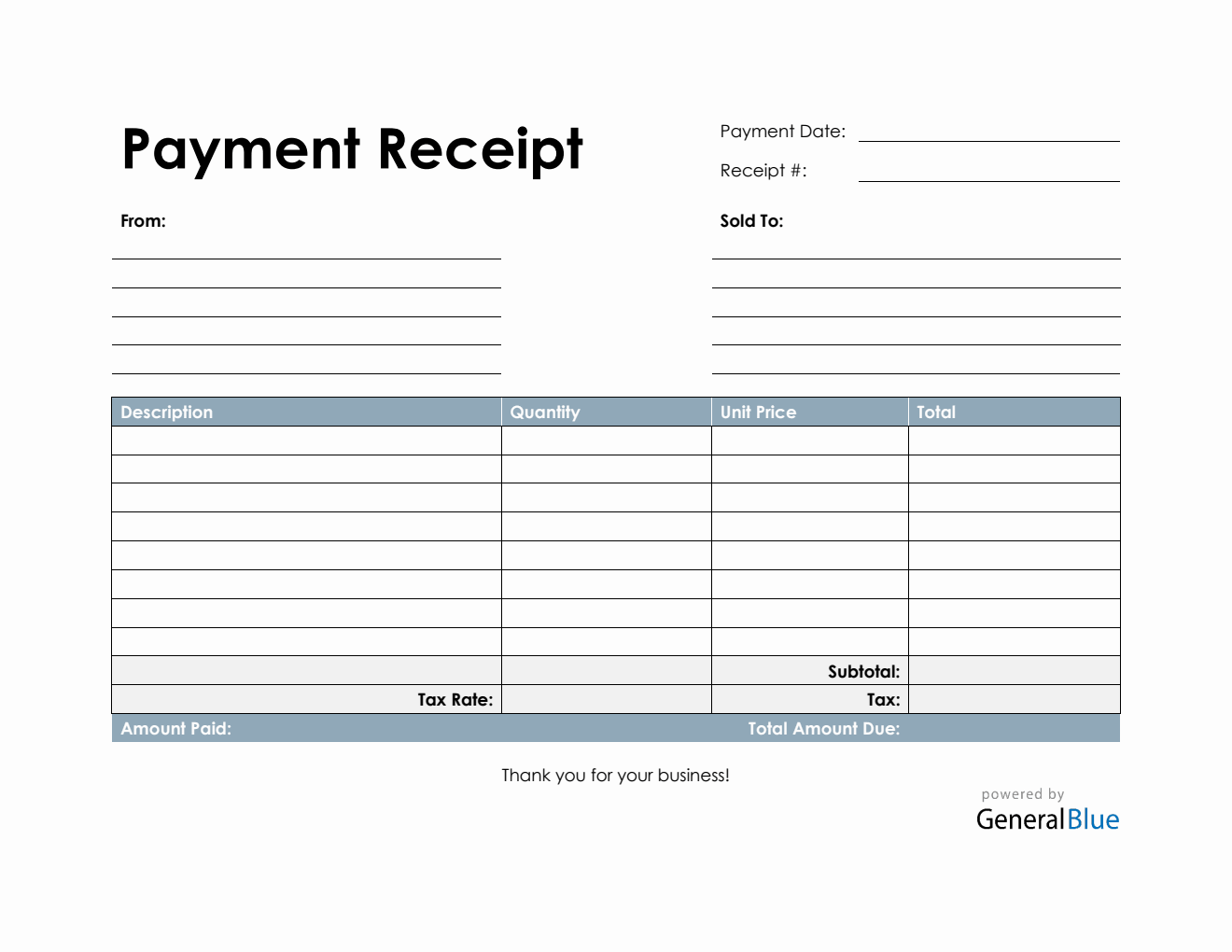

Important Components of a Receipt for Payment

When it comes to making a payment, having a receipt is crucial. It serves as proof of the transaction and can be used for various purposes such as tax deductions or dispute resolutions. Here, we will discuss the important components that should be included in a receipt for payment.

Date

The date is one of the most critical elements on a receipt. It serves as evidence that the transaction took place on a specific day and time. The date should be clear, easy to read, and include the year, month, and day.

For example: “Payment Received on January 15, 2023”

Description of Goods or Services

The description of goods or services is another essential component of a receipt. It provides details about what was purchased and the value of each item. This information helps in case there are any discrepancies or disputes regarding the payment.

For example: “Payment for two tickets to a concert valued at $100 each”

Amount Paid

The amount paid indicates the total cost of the goods or services purchased and helps in keeping track of expenses.

For example: “Total payment: $200”

Currency

The currency used on the receipt indicates the type of money that was used for the transaction and helps in understanding the value of the goods or services purchased.

For example: “Payment made in US dollars”

Signature of the Seller/Vendor

The signature of the seller or vendor serves as evidence that the transaction took place between two parties and helps in identifying the person responsible for providing the goods or services.

For example: “Signed by John Doe, Owner”

Name and Address of the Seller/Vendor

The name and address of the seller or vendor provides details about who the person is and where they can be reached in case there are any issues with the transaction.

For example: “John Doe, 123 Main Street, Anytown USA”

Taxes Paid (if applicable)

If taxes were paid as part of the transaction, it should be indicated on the receipt. This information is important for tax purposes and helps in keeping track of expenses.

For example: “Sales tax of 8% was added to the total amount”

Method of Payment

The method of payment used on the receipt is another essential component. It indicates how the payment was made and helps in understanding the transaction better.

For example: “Payment made via credit card”

References or Invoices (if applicable)

If there were any references or invoices associated with the transaction, they should be indicated on the receipt. This information is important for keeping track of expenses and resolving disputes.

For example: “Invoice number: 12345”

Writing Styles for a Receipt for Payment Template

In today’s fast-paced business world, accurate and efficient record keeping is crucial for success. One important aspect of this is creating a receipt for payment template that clearly outlines the details of each transaction. In this article, we will explore different writing styles for a receipt for payment template to help you create professional and effective documents.

Formal Writing Style

A formal writing style is typically used in legal or financial contexts where accuracy and precision are paramount. This style should include all relevant details such as the date, parties involved, payment amount, and description of goods or services provided.

When using a formal writing style, it’s important to use clear and concise language that is easy to understand. Avoid using jargon or technical terms that may be confusing to the reader. Instead, focus on providing all necessary information in a straightforward manner.

Informal Writing Style

An informal writing style is more relaxed and conversational, making it suitable for personal transactions such as gifts or small purchases. This style should still include the essential details of the transaction but can be presented in a more casual manner.

Consider adding a personal touch to make the document more relatable and friendly. For example, you could add a brief note of thanks or express your appreciation for the goods or services received.

Modified Writing Style

A modified writing style is a middle ground between formal and informal styles. It’s suitable for transactions that require a more professional tone but still maintain a personal touch. This style should include all necessary details while also incorporating a friendly tone.

Focus on providing clear and concise information while also adding a personal touch to make the document more relatable. For example, you could add a brief description of the goods or services received or express your gratitude for the transaction.

Creative Writing Style

A creative writing style is ideal for transactions that require a unique and memorable experience. This style should include all necessary details while also incorporating elements of storytelling to make the document more engaging and enjoyable to read. You could include a brief narrative about the transaction or use descriptive language to paint a picture of the goods or services received.

Choosing the right writing style for your receipt for payment template is essential for creating professional and effective documents. Whether you opt for a formal, informal, modified, or creative style, make sure to include all necessary details while also incorporating elements that make the document more relatable and memorable.

DocuKng’s Curated Example Templates for Receipts

Example of a Receipt for Payment

DATE: 01/25/2023

RECEIPT NUMBER: R-001

Bill To:

Name: John Doe

Address: 123 Main St, Anytown USA

City: Anytown

State: CA

Zip Code: 12345

Phone Number: (555) 555-5555

Email: [johndoe@email.com](mailto:johndoe@email.com)

Ship To:

Name: John Doe

Address: 123 Main St, Anytown USA

City: Anytown

State: CA

Zip Code: 12345

Phone Number: (555) 555-5555

Email: [johndoe@email.com](mailto:johndoe@email.com)

Payment Details:

Invoice Number: INV-001

Amount Due: $1,234.56

Payment Method: Credit Card (Visa)

Cardholder Name: John Doe

Card Type: Visa

Expiration Date: 05/25/2023

CVV Code: 123

Billing Zip Code: 12345

Shipping Address:

Name on Card: John Doe

Address: 123 Main St, Anytown USA

City: Anytown

State: CA

Zip Code: 12345

Phone Number: (555) 555-5555

Email: [johndoe@email.com](mailto:johndoe@email.com)

Order Details:

Product Name: Widget XYZ

Quantity: 1

Unit Price: $100.00

Subtotal: $100.00

Shipping Cost: $5.00

Total: $105.00

Terms and Conditions:

By signing below, the customer acknowledges that they have received and reviewed this receipt for payment and agree to all terms and conditions outlined herein.

Optimizing Your Receipt for Payment Template

When it comes to receiving payment, having a well-designed receipt is crucial. Not only does it provide clarity and transparency for both parties involved in the transaction, but it also helps to avoid any potential disputes or misunderstandings. In this article, we will discuss how you can optimize your receipt for payment template to ensure that it meets all of your needs and expectations.

Choosing the Right Receipt Template

The first step in optimizing your receipt for payment is selecting the right template. There are many different templates available online, each with its own unique features and benefits. To choose the best one for you, consider what type of business you have, what types of transactions you typically handle, and what information you need to include on your receipt.

Once you’ve identified a few potential templates, take some time to review them carefully. Look for any customization options or features that may be particularly useful for your needs. It’s also important to ensure that the template is compatible with your point-of-sale system and other software applications that you use regularly.

Customizing Your Receipt Template

Once you’ve selected a receipt template, it’s time to start customizing it to meet your specific needs. This may involve adding or removing fields, changing the layout or design of the template, or modifying any other aspect of the template that doesn’t quite fit your requirements.

When customizing your receipt template, keep in mind that less is often more. Don’t include unnecessary information on your receipt, as this can clutter up the document and make it harder to read. Instead, focus on including only the most important details, such as the date of the transaction, the amount paid, and any relevant product or service codes.

Testing Your Receipt Template

Before you start using your new receipt template in real-world transactions, it’s important to test it thoroughly. This will help you identify any errors or issues that may have been overlooked during the customization process, and ensure that everything is working as intended.

Try creating a few sample transactions using the template. Then, review each transaction carefully to make sure that all of the necessary information has been captured correctly. If you notice any errors or issues, make the necessary adjustments and repeat the testing process until you’re confident that your template is ready for use.

Finalizing Your Receipt Template

Once you’ve completed all of the customization and testing steps, it’s time to finalize your receipt template. This may involve making any final adjustments or modifications based on your feedback, and ensuring that everything is in compliance with any relevant laws or regulations.

When finalizing your receipt template, keep in mind that it’s important to maintain a consistent look and feel across all of your transactions. This will help to ensure that your customers have a clear understanding of what information they can expect to see on each receipt, and make it easier for you to manage your financial records over time.

With this, optimizing your receipt for payment template is an important step in ensuring that your business runs smoothly and efficiently. By carefully selecting the right template, customizing it to meet your specific needs, testing it thoroughly, and finalizing it with care, you can create a receipt that provides clarity and transparency for both parties involved in each transaction.