When it comes to payment receipts, there are several terms that you should be familiar with. Understanding these terms will help you create a more accurate and comprehensive document. Here are some of the most important terms to keep in mind:

- Date: This is the date on which the payment was received.

- Amount: The total amount paid, including any taxes or fees.

- Description: A brief description of the goods or services provided.

- Payment Method: The method used to make the payment, such as credit card, check, or cash.

- Signature: The signature of the person who made the payment.

A payment receipt is a document that confirms the transaction between two parties. It should include all relevant information about the payment, including the date, amount, description, and payment method. Here are some of the most important components to include in your payment receipt:

- Date: The date on which the payment was received.

- Amount: The total amount paid, including any taxes or fees.

- Description: A brief description of the goods or services provided.

- Payment Method: The method used to make the payment, such as credit card, check, or cash.

- Signature: The signature of the person who made the payment.

When it comes to writing a payment receipt, there are several styles that you can use. Each style has its own advantages and disadvantages, so it’s important to choose the one that best suits your needs.

- Formal Style: This style is appropriate for business transactions and includes all relevant information about the payment. It is often used in legal or financial contexts.

- Informal Style: This style is more casual and may be used for personal transactions, such as a friend borrowing money.

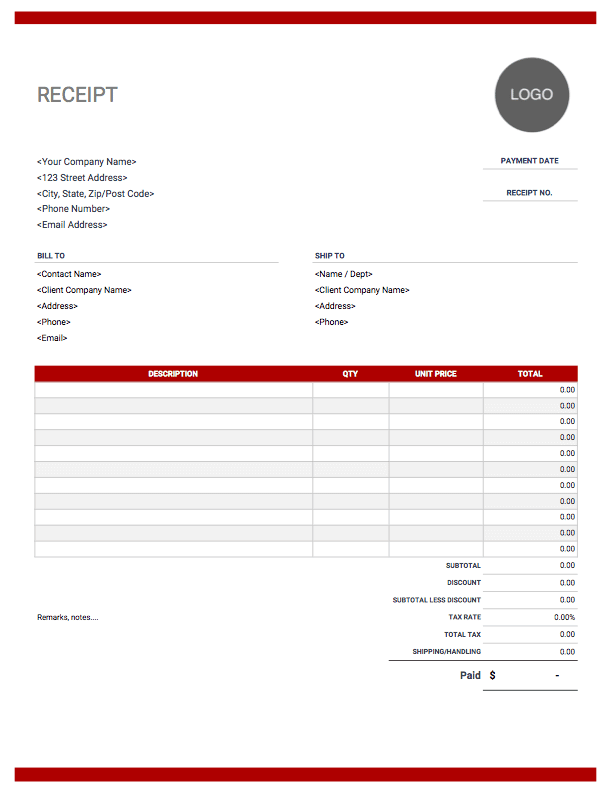

If you’re having trouble creating your own payment receipt, there are several templates available online that you can use. DocuKng offers curated example templates that you can customize to fit your needs. These templates include all the necessary information and can be easily edited to reflect your specific transaction.

When it comes to optimizing your payment receipt format, there are several things you can do. Here are some tips to help you create a more effective document:

- Include all relevant information about the payment.

- Use clear and concise language.

- Make sure the layout is easy to read and understand.

- Customize the template to fit your specific needs.

If you’re new to payment receipts, you may have some questions about how they work. Here are some common questions that can help you better understand this important document:

- What should be included in a payment receipt?

- How do I create a payment receipt?

- Can I use a template to create my payment receipt?

- Do I need to include my signature on the payment receipt?

| Sections | Topics Covered |

|---|---|

| Payment Receipt Word Format: Glossary of Vital Terms | Key terms and definitions related to payment receipts |

| Receipt Format for Payment: Important Components | Essential elements of a payment receipt format |

| Payment Receipt Word Format: Recommended Writing Styles | Best practices for writing payment receipts in a clear and concise manner |

| DocuKng Curated Example Templates | Examples of payment receipt formats curated by DocuKng |

| Ways to Optimize Payment Receipt Formats | Strategies for improving the design and functionality of payment receipts |

| Common Questions on Payment Receipt Formats | Frequently asked questions about payment receipt formats and their implementation |

Payment Receipt Word Format: Glossary of Vital Terms

Electronic Funds Transfer (EFT): A method of transferring funds from one bank account to another electronically, typically used for recurring payments or large transactions.

Payment Gateway: An online service that enables businesses to process credit card and electronic payment transactions securely.

Recurring Payment: A payment arrangement in which a customer’s credit card or bank account is automatically charged for a product or service on a regular basis, such as monthly subscriptions.

Payment Processor: A company that provides the technical infrastructure and services to enable online payments, including payment gateways and fraud prevention tools.

Positive Pay A system used by businesses to verify the authenticity of a check by comparing it to an approved list of checks issued by the company.

Return on Investment (ROI): A performance measure used to evaluate the efficiency of an investment, calculated as the ratio of benefit:cost.

Payment Receipt: A document issued by a business to a customer as proof of payment for goods or services rendered, typically including details such as the date, amount, and description of the transaction.

Payment Schedule: The timetable for when payments are due and when they must be paid, often used in contracts and leases to establish a regular payment plan.

Payment Security: Measures taken to protect online transactions from fraud, such as encryption, tokenization, and secure socket layer (SSL) technology.

Payment Tokenization: The process of replacing sensitive payment information, such as credit card numbers, with a unique identifier known as a “token,” which is used to complete transactions without revealing the original data.

Payment Fraud: A type of financial crime in which an individual or organization uses deception to obtain money or assets through fraudulent means, such as identity theft or phishing scams.

Receipt Format for Payment: Important Components

When it comes to payment receipts, there are several important components that should be included in order to ensure accuracy and clarity. Here, we will discuss the key elements of a payment receipt and why they matter.

What is a Payment Receipt?

A payment receipt is a document that serves as proof of payment for goods or services rendered. It typically includes information such as the date of the transaction, the amount paid, the name of the payer, and the name of the payee. A payment receipt can be issued by a business or an individual, and it serves as evidence of a financial transaction.

Important Components of a Payment Receipt

- Date: The date of the transaction should be clearly stated on the payment receipt. This helps to establish when the payment was made and can be useful for tax purposes or in case of any disputes.

- Amount Paid: The amount paid is a crucial component of a payment receipt. It should be clearly stated, along with any applicable discounts or taxes that were applied. This helps to avoid confusion and ensures that both parties are clear on the terms of the transaction.

- Payer’s Name: The name of the payer is also important for identification purposes. It helps to establish who made the payment, which can be useful in case of any disputes or if there are questions about the payment.

- Payee’s Name: The name of the payee should also be clearly stated on the payment receipt. This helps to identify the business or individual that received the payment and ensures that both parties are aware of who is responsible for providing goods or services.

- Description of Goods/Services: A description of the goods or services provided should also be included on the payment receipt. This helps to establish what was paid for, which can be useful in case of any disputes or if there are questions about the transaction.

- Signature: In some cases, a signature may be required as proof that both parties have agreed to the terms of the transaction. This is particularly important when dealing with large sums of money or complex transactions.

- Payment Method: The payment method used should also be clearly stated on the payment receipt. This helps to establish how the payment was made and can be useful in case of any disputes or if there are questions about the transaction.

Conclusion

With this, a payment receipt is an important document that serves as proof of payment for goods or services rendered. It is essential to include all relevant information on the payment receipt, including the date of the transaction, the amount paid, the name of the payer and payee, a description of the goods/services provided, and any applicable discounts or taxes. By including these key components, you can ensure that your payment receipts are accurate, clear, and easy to understand.

Payment Receipt Word Format: Recommended Writing Styles

When it comes to creating a payment receipt, there are certain writing styles that can make the process easier and more efficient. In this article, we will discuss some of these recommended writing styles for payment receipts in Microsoft Word format.

One of the most important things to keep in mind when creating a payment receipt is to use simple language that is easy to understand. This means avoiding complex words and phrases that may confuse the reader. Instead, focus on using clear and concise language that accurately reflects the transaction.

Instead of writing “The customer has been credited with the amount of X dollars,” you can simply write “Customer paid X dollars.” This makes the receipt easier to read and understand, which is especially important if the payment receipt will be shared with multiple parties.

Use Bullet Points

Another recommended writing style for payment receipts in Microsoft Word format is to use bullet points. This can help break up long blocks of text and make it easier for the reader to scan through the information quickly.

If you are creating a payment receipt for a service, you can list out the services provided along with their respective prices. This makes it easy for the customer to see exactly what they paid for and helps prevent any confusion or misunderstandings.

Use Formatting Tools

Another recommended writing style for payment receipts in Microsoft Word format is to use formatting tools such as bold text, underlining, and italics. These formatting tools can help draw attention to important information on the receipt and make it easier for the reader to scan through the document quickly.

You can use bold text to highlight the customer’s name or payment amount, which makes it easy for the reader to identify this information at a glance. Additionally, you can use underlining or italics to emphasize specific terms and conditions that are important to understand before signing the receipt.

There are several recommended writing styles for payment receipts in Microsoft Word format that can make the process easier and more efficient. By using simple language, bullet points, and formatting tools, you can create a payment receipt that is clear, concise, and easy to understand for all parties involved.

DocuKng Curated Example Templates

Example of Payment Receipt Format

Payment Received from: John Doe

Address: 123 Main St, Anytown USA

Date: April 15, 2023

Amount: $100.00

Description: Monthly Subscription Fee

Payment Method: Credit Card (Visa)

Transaction ID: 123456789012345

Ways to Optimize Payment Receipt Formats

Payment receipts are an essential part of any business transaction. They serve as proof of payment and help keep track of financial records. However, optimizing payment receipt formats can be a daunting task for many businesses. In this article, we will explore some effective ways to optimize payment receipt formats.

Choose the Right Format

The first step in optimizing payment receipt formats is choosing the right format. There are various types of payment receipts, including electronic receipts, paper receipts, and mobile receipts. Each type has its advantages and disadvantages, so it’s essential to choose the one that suits your business needs.

If you operate an e-commerce store, electronic payment receipts are the best option as they can be easily accessed by customers through their email or online account. On the other hand, paper receipts are ideal for brick-and-mortar stores where customers prefer to receive a physical copy of their purchase.

Include All Necessary Information

Another crucial aspect of optimizing payment receipt formats is including all necessary information. A payment receipt should contain the date, transaction details, merchant name, and total amount paid. Failure to include this information may lead to confusion or disputes.

Moreover, it’s essential to ensure that the payment receipt is easy to read and understand. Use clear fonts, concise language, and avoid using jargon or technical terms that customers may not comprehend.

Use a Professional Design

The design of your payment receipt can also impact its effectiveness. A well-designed payment receipt can help build trust with customers and make it easier for them to understand the transaction details.

Consider using a professional template that is easy to read, visually appealing, and consistent with your brand identity. You may also want to include your company logo or use a color scheme that matches your website or marketing materials.

Provide Clear Instructions for Disputes

It’s essential to provide clear instructions for customers who wish to dispute a payment. Include information on how they can file a dispute, the timeframe within which disputes must be filed, and any relevant contact details or support channels.

By providing clear instructions, you can help reduce the likelihood of disputes and improve customer satisfaction.

Conclusion

Optimizing payment receipt formats may seem like a small task, but it’s crucial for maintaining accurate financial records and building trust with customers. By choosing the right format, including all necessary information, using a professional design, and providing clear instructions for disputes, you can ensure that your payment receipts are effective and efficient.

Common Questions on Payment Receipt Formats

How do I write a receipt for payment?

To write a receipt for payment, you can use a document template repository like DocuKng or another brand that offers customizable templates. Start by creating a new document and selecting the ‘Receipts’ category. Choose a suitable template and customize it with your company’s information, date, amount, and any other relevant details. Save the document and print or email it to the recipient.

What is the format of a receipt?

The format of a receipt typically includes the date, name and address of the seller, a brief description of the items or services provided, the total amount due, and any applicable taxes. The receipt may also include the signature of the buyer and the seller, as well as any other relevant information.

What is an example of a receipt of payment?

An example of a receipt for payment could be a document issued by a retail store that lists the date, name and address of the store, a brief description of the items purchased, the total amount due, and any applicable taxes. The receipt may also include the signature of the buyer and the cashier.